Over the last few decades, there has been a bigger spread of wealth. Many people have assets to protect and die with a sizeable estate. This wealth, combined with higher mortality rates, translates to the number of adults inheriting larger amounts of money being set to rise from £69 billion (2017) to £115 billion by 2027, with almost £1 trillion expected to pass between generations over the course of a decade!

(Source The CEBR’s “Passing on the Pounds” report May 2017).

In direct contrast to this, younger generations complain of the constant struggle to get on the housing ladder and keep up with the increasing cost of living. Complex family structures also mean that the division of assets becomes ever more challenging, and can be felt to be inherently unfair by aggrieved family members. Inheritance disputes brought to court have been rising since 2015 as a result – and the trend looks set to continue.

An ageing population and increase in dementia rates means that more people are making Wills when they may not be in the best of health and so the Wills are more susceptible to challenge. These factors, along with a growing ‘compensation culture’ and people becoming more aware of their legal rights from stories and articles in the media and the ability to bring a claim if there is something they see as unfair or amiss, means more of an incentive and appetite to litigate.

The need to protect both your clients and your Will writing business has never been greater.

HOW can you protect your clients and your business?

When you take a client’s last Will and Testimony it is of particular importance to take full instructions accounting for the client’s needs, wishes and circumstances.

However, a clients’ Will only really describes WHAT they wish to do with their estate, and doesn’t include any of their deciding factors or circumstances surrounding the Will drafting and execution, which may be questioned at a later date.

Ok so that covers the WHAT they want to do, but what about the WHY, the HOW, the WHERE, the WHEN and the WHO?

You have a Duty of Care to your clients and their chosen beneficiaries.

Under the STEP Code for Will preparation it clearly states that as part of the Will drafter’s duty of care they are required to:

- The Will drafter must take adequate notes of the client’s instructions and the advice that they have given to the client and preserve these notes in the Will file.

- The client should be provided with a record of the Will instructions, usually by way of a copy of an attendance note, fact find or questionnaire (or failing that by letter). Where this is not possible, then the client must be provided with a draft or copy Will ahead of being asked to execute the final document, with the opportunity to ask questions or seek explanations before execution of the Will. Where time constraints make this impossible, a greater onus is placed on the Will drafter to provide explanations and encourage questions from the client

It’s clear that it’s of equal importance to both accurately record all events during the instruction taking process and retain these along with the Will, in order to be able to fully respond any potential future claims and so protect your clients’ wishes.

So what’s the problem?

Well, perhaps there isn’t one as long as:

- You are confident that nothing could ever be omitted during the instruction taking process which you may rely upon later.

- You’re happy that continuing to spend your own time transposing client notes into your Will drafting system is an appropriate use of your time.

- Where notes are hand written that they cannot become lost or damaged and can be read and understood long after the event.

- Where Will files are passed to a member of staff to complete, you are confident in their ability to read and interpret the notes appropriately.

Even if you do feel that you are working in the right way doesn’t mean that there isn’t

a better way.

With many more disgruntled beneficiaries now actively being encouraged to contest Wills and Solicitor firms using Larke v Nugus requests as “fishing expeditions” the chances of your having to respond to one or more of these complaints is inevitable.

Receiving a Larke v Nugus request can be exceptionally time consuming and expensive to your practice and with an increasing trend of Contentious Probate, the requirement for systematic record keeping has never been more important.

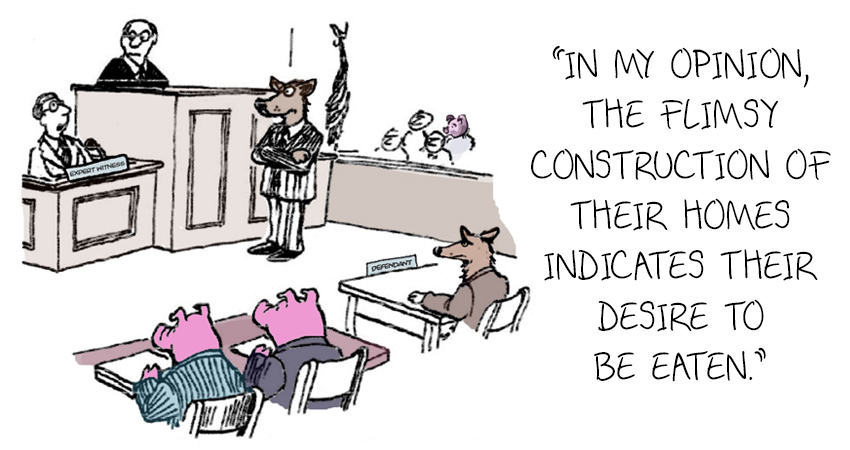

If, like the 3 little pigs, you don’t want YOUR house to blow down then you need to ensure that you have the right procedures in place to protect your clients and your reputation.

Will your current business practices be able to keep “the wolf from the door”?

Countrywide Legacy, in partnership with Martin Holdsworth, Contentious Probate Lawyer and owner of IDR Law which specialises in Inheritance Dispute Resolution, has developed a complete Will Clarity Package which is totally unique to the legal industry.

Our Software Package automatically compiles statements which fully satisfies the WHY, WHEN, WHERE, HOW and WHO when it comes to your clients Will, their wishes and the surrounding circumstances. This helps protect your business by reducing the risk of a successful challenge. It also ensures you are providing your clients with the best possible service, helping to give “the deceased a voice”.

How does it work?

The Will Clarity package is a Three Step Process and has been specifically designed to ensure your business is fully prepared for when a challenge is received:

Step 1. Choose the best tools for the job– the software will populate all the relevant questions during the Will instruction taking process, guiding you seamlessly through the contentious areas of any Will and fully detailing the “reasons why” the Testator has made the choices they have. The software enables you to automatically produce a Will Clarity Statement for each and every client, at the touch of a button! This statement is then read and signed by the client as confirmation, which can even be done electronically. Securely stored within the software this essentially “gives your client a voice” after they have gone, safe guarding your clients against potential future claims from disgruntled beneficiaries.

Step 2. Lay solid foundations – once the legal documents have been drafted to the client’s satisfaction, they need to be correctly executed. Our software manages the entire execution process populating the relevant questions surrounding execution, and automatically compiling an Execution Statement, which is a complete record of how, when, where and by whom the documents were signed and witnessed thereby reducing the risk of any doubts on their validity.

Step 3. Ensure it’s 100% weather proof – With the information from both the Will Clarity and Execution statements securely stored in the software, you will be able to automatically generate a full Larke V Nugus statement, at the touch of a button, in response to any request whenever they might be received, saving you valuable time and money. In addition, a Larke V Nugus statement can also be generated for existing cases.

Countrywide Legacy’s Will Clarity Package software package ensures that you automatically compile and store all the information required to protect your clients and to be able to fully respond to a Larke v Nugus request. By seamlessly steering you through the relevant questions incorporated into the Instruction taking process, the Will Clarity statement and the Execution statement, means that you can never miss anything out and always have an accurate and comprehensive record of your client meetings, ultimately protecting your business whilst doing right by your clients, giving the “deceased a voice”.